COVID-19

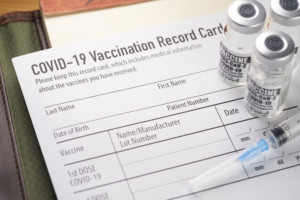

Last week we discussed actions property management employers can take while waiting for the new federal vaccine mandate to be finalized. As we mentioned, the mandate will likely impact many of your organization’s processes, such as recordkeeping, confidentiality, reasonable accommodations, and more. While it’s too soon to implement a vaccine policy, now is a great… Read More »

Read MoreTo contain the recent surge in COVID-19 cases, President Biden has proposed a new federal vaccine mandate applicable to certain businesses. The mandate includes the strictest vaccination requirements yet imposed and could affect almost two-thirds of the American workforce, including the property management industry. While the mandate isn’t anticipated to go into effect for several… Read More »

Read MoreIn the recent AIM Conference webinar “Take a Journey Through the Eyes of a Renter,” leading apartment professionals discussed how to keep mystery shopping effective and relevant to today’s leasing environment. Webinar participants Jessica Fern, Director of Training and Development, FPI Management; Joy Zalaznick, Director of Training and Development, Kettler Enterprises; and Darcey Forbes, Senior… Read More »

Read MoreHow Self-Guided Tours Benefit Renters At the onset of the pandemic, property managers were forced to find alternatives to traditional leasing, and virtual leasing became the clear front-runner. Now that offices have opened up and people better understand the virus, self-guided tours are becoming more popular. The increased convenience and comfort of self-guided tours… Read More »

Read MoreEven during the most severe COVID-19 quarantine lockdowns, onsite teams have never stopped working to keep their communities safe. SightPlan CEO Terry Danner is celebrating these everyday frontline heroes in the groundbreaking video series, “Back to Work with Terry Danner.” Grace Hill is delighted to partner with SightPlan and HD Supply to share this journey… Read More »

Read MoreTips for establishing your strategy on rent collection, late fees, and evictions upon reopening.

Read MoreStragies for balancing resident satisfaction and safety when resuming amenity and maintenance services.

Read MoreA new series of free articles and tools that help multifamily companies balance safety, resident satisfaction, company viability, and legal compliance while reopening

Read MoreStrategies for maintaining an excellent customer experience regardless of whether the leasing is done virtually or in-person.

Read MoreTop reasons why your virtual leasing program may not be living up to its full profit potential.

Read MoreA roundup of articles offering solid advice on how property management companies can maintain safety and stability in these uncertain times.

Read More