The key to keeping buildings leased is to make sure tenants are happy. Buildings with satisfied tenants are more likely to retain existing tenants and to attract new ones through favorable word of mouth.

In a whitepaper, Grace Hill reported on the results of an important academic study based on KingsleySurveys data showing that office tenant satisfaction elevates commercial real estate performance. The research by economists at Maastricht University and MIT confirmed that highly satisfied tenants are more likely to renew their lease and recommend their building to other firms.

But what drives tenant satisfaction? The location and quality of the building have always mattered a great deal, of course. Since the start of the pandemic, office tenants have shown increasingly strong preferences for the newest, highest-quality buildings. These buildings command higher occupancies and rents than otherwise similar buildings.

However, that insight doesn’t help a property manager much; a building’s location is fixed, and upgrading the physical quality of a building takes considerable capital investment and time. So, what can a property manager do in the short term to improve property performance? They can enhance the tenant experience through more effective property management and focus on the issues that matter most to tenants. These enhancements need not be expensive but can increase revenue by raising both occupancy and, ultimately, rent, yielding meaningful returns on investment – at a much lower cost basis than required for most capital improvements.

What Matters to Office Tenants

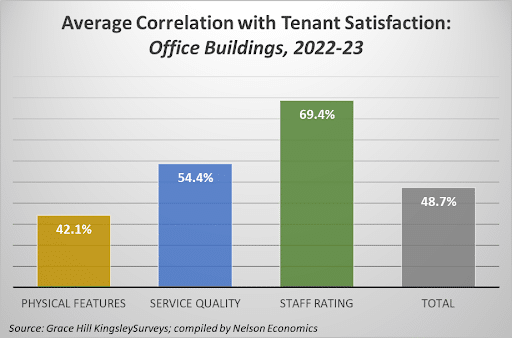

Turns out, the service tenants receive from management, and especially the tenants’ ratings of management staff, matters a great deal – perhaps even more than physical building qualities.

That’s the conclusion from tenant responses to Grace Hill’s KingsleySurveys. The data shows various factors that closely correlate to tenant satisfaction; they are divided into three categories of building ratings:

- Physical (e.g., location and building quality)

- Service (e.g., quality of cleaning or ease of leasing)

- Staff rating (e.g., the responsiveness of management)

Note that some factors do not fall neatly into one of these categories, like security, which has both physical and management elements. Results of the surveys for office tenants demonstrate the critical role that property management plays in tenant satisfaction. On average, the factors under direct management control matter more to tenants than physical qualities. Physical attributes have an average correlation to tenant satisfaction of just 42%, compared to 54% for service delivery. The highest correlation to tenant satisfaction is with management staff ratings at almost 70%.

In fact, five of the top six factors, including all of the top four, concern management staff ratings: overall satisfaction, problem resolution, communication, responsiveness, and accessibility. The fifth highest correlation with tenant satisfaction concerns the leasing process. The highest ranking of any physical attribute is for satisfaction with tenant improvements at #7.

This is not to say that physical qualities are not important. Clearly, they are, as evidenced by the superior performance metrics for newer, well-located buildings. But these physical qualities likely matter more for determining where prospective tenants choose to locate initially. However, once a tenant selects a building, the quality and service levels of the management staff seem to be more important in determining whether the tenant is happy and ultimately inclined to renew the lease.

This data is crucial insight for landlords and property managers. Upgrading the quality of their service provision is usually much less costly – and can be more effective for retaining tenants – than investing in expensive capital improvements. The result is a greater return on investment (ROI).

Apartment Dwellers Appreciate Good Service Too!

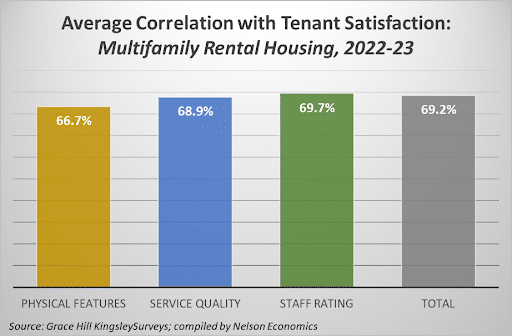

The situation is similar for residents of multifamily residential buildings, albeit less extreme. KingsleySurveys by Grace Hill again shows that physical features have a lower correlation to tenant satisfaction than either service quality or staff ratings, though the differences are much less. Yet the lesson is the same: Investing in quality staff and service provision can yield greater results and higher returns than investing in physical improvements.

Do you want to capture data on your specific properties? Contact the experts at Grace Hill to learn how KingsleySurveys can provide unbiased insights on your tenant or resident experience.

Customer Support

Customer Support