COVID-19 has upended U.S. property markets in many ways, but three years after the pandemic began, the commercial office segment is taking the biggest hit. While almost every property type is experiencing its own challenges, the office sector is seeing the greatest long-term threat to tenant demand. Older buildings are the most vulnerable to occupancy losses. Succeeding in this competitive market will require owners to be even more vigilant in maintaining excellent communication with their tenants.

The cause of the office distress is obvious: Firms sent their employees home when the economy went into lockdown in March 2020. Then, what started as an emergency experiment with remote working, has been permanently adopted by firms in every major office-inclined business sector. A few firms have gone fully remote, but most have moved to some hybrid form of remote and in-office work arrangement that reduces overall office usage.

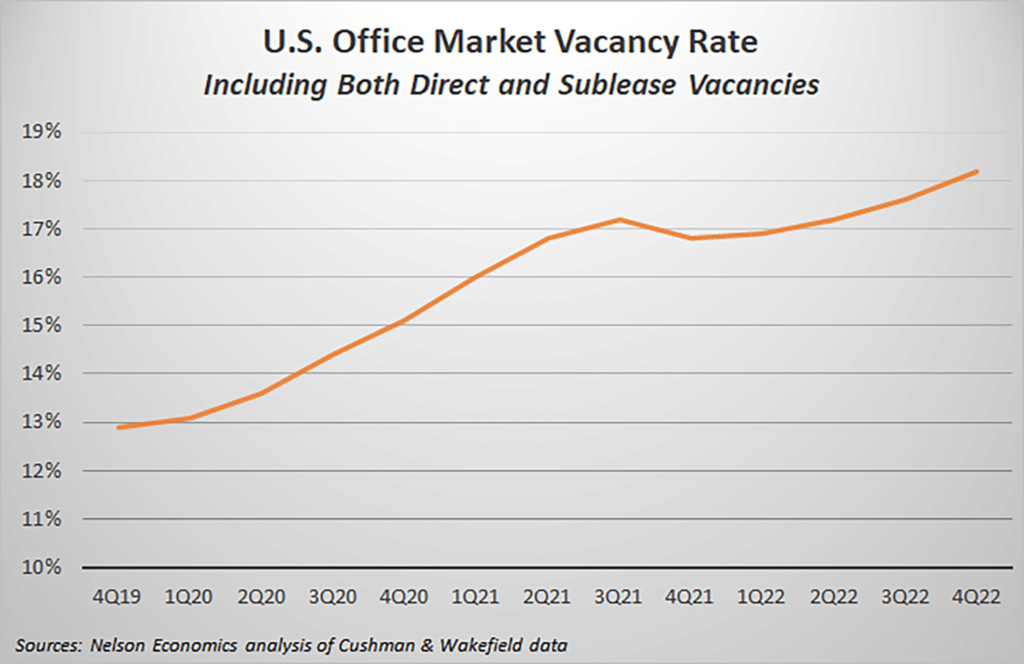

As a result, firms are actively looking to shed their excess space. The rise in vacancies has been slowed by the long duration of most leases, generally lasting five or more years, and firms generally cannot walk away from their obligations. But vacancies continue to rise as leases expire, and many tenants either do not renew or take down less space than they had previously. So far, the national vacancy rate has increased from under 13% to over 18%.

And vacancies are set to increase further. Firms are trying to sublease their idle space until their leases expire. Sublease availability has doubled since the pandemic began – a clear indication of future office vacancy trends. Most of this space will eventually become the landlord’s responsibility, adding to the inventory of vacant space.

Tenant Flight to Quality Means a More Competitive Landscape

All of this means an increasingly challenging market for office owners and managers. With so many vacant spaces available, firms can be extra choosy about where and what they will lease. What are tenants looking for? The answer: newer buildings that offer accessible locations, first-class amenities and services, appealing designs, and functional layouts. And probably most important, with our memories still scarred from pandemic fears, tenants demand buildings perceived to provide superior health and safety features.

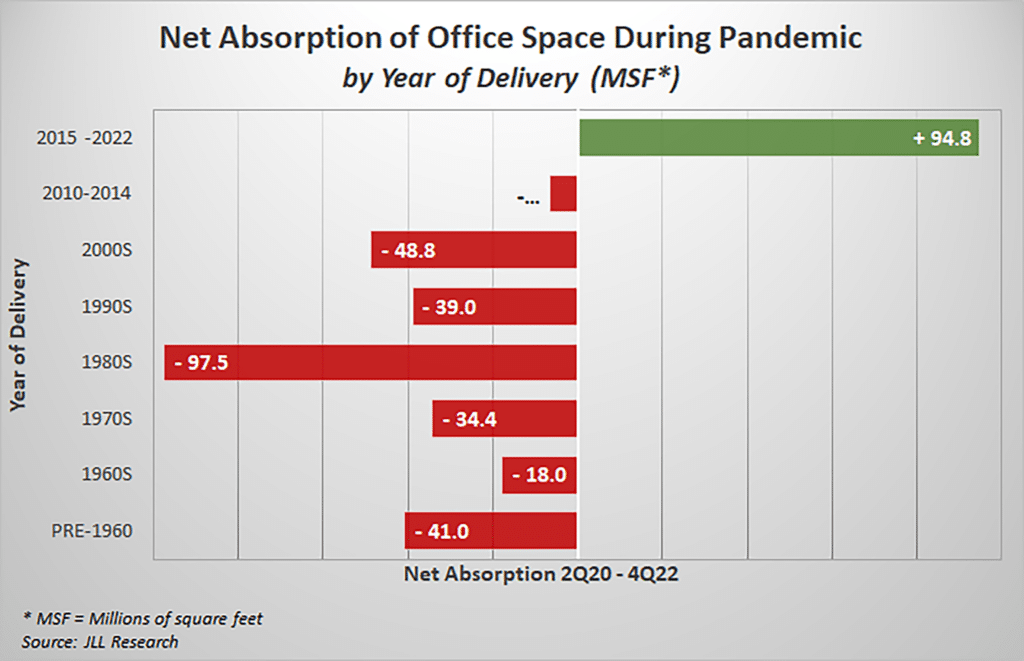

In theory, buildings of any vintage can be renovated to provide these features, but tenants are showing a clear preference for the newest buildings. Since the onset of COVID, net absorption of space – that is, new leasing minus lease expirations – has been strongly positive for buildings constructed after 2014 but negative for every other construction vintage.

There is still plenty of leasing activity going on in older buildings, of course. In fact, since newer buildings account for a relatively small share of the total inventory, older buildings actually capture most of the leasing activity. Nonetheless, this analysis demonstrates that tenants clearly prefer to be in newer buildings. Thus, owners of older stock must work harder to retain and attract tenants.

Remaining Competitive Starts With Effective Tenant Communication

How should office building owners and managers respond, particularly in the 90%+ share of buildings over 10 years old? Many owners will need to upgrade their inefficient HVAC systems to be more effective and add more window area to maximize natural light. Tenants also expect sustainable designs that minimize the building’s carbon footprint. But these renovations require time and substantial capital to complete.

That being said, there is still much that owners do right now to help keep their buildings leased. Job #1 is retaining existing tenants. Tenant retention is much less expensive than finding and signing new tenants and fitting out their space. Tenant allowances tend to be much less for existing tenants because the space has already been planned for them – even if it must be refreshed periodically.

The best way that owners can reduce turnover is by creating exceptional experiences for current tenants, which requires understanding their needs and preferences. That awareness begins with an outstanding program of continual tenant engagement. The conversation cannot start at lease renewal time. Rather, the engagement should begin with the lease commencement to ensure the tenant’s needs are known and addressed. This engagement also provides opportunities for landlords to communicate about what they are doing to elevate the building experience, as well as initiatives they can work on jointly with tenants. Finally, this dialogue can build trust and community, raising the odds of lease renewal and reducing turnover.

Leveraging unbiased tenant engagement feedback to guide investment decisions can help owners deliver the amenities and experiences that tenants actually want, instead of providing what owners think they want. KingsleySurveys has been trusted by the commercial real estate industry for 35 years and can help you implement an ongoing engagement program that can offer the insight needed to increase renewals and reduce vacancies.

Want to know more? Contact our team of CRE experts today.