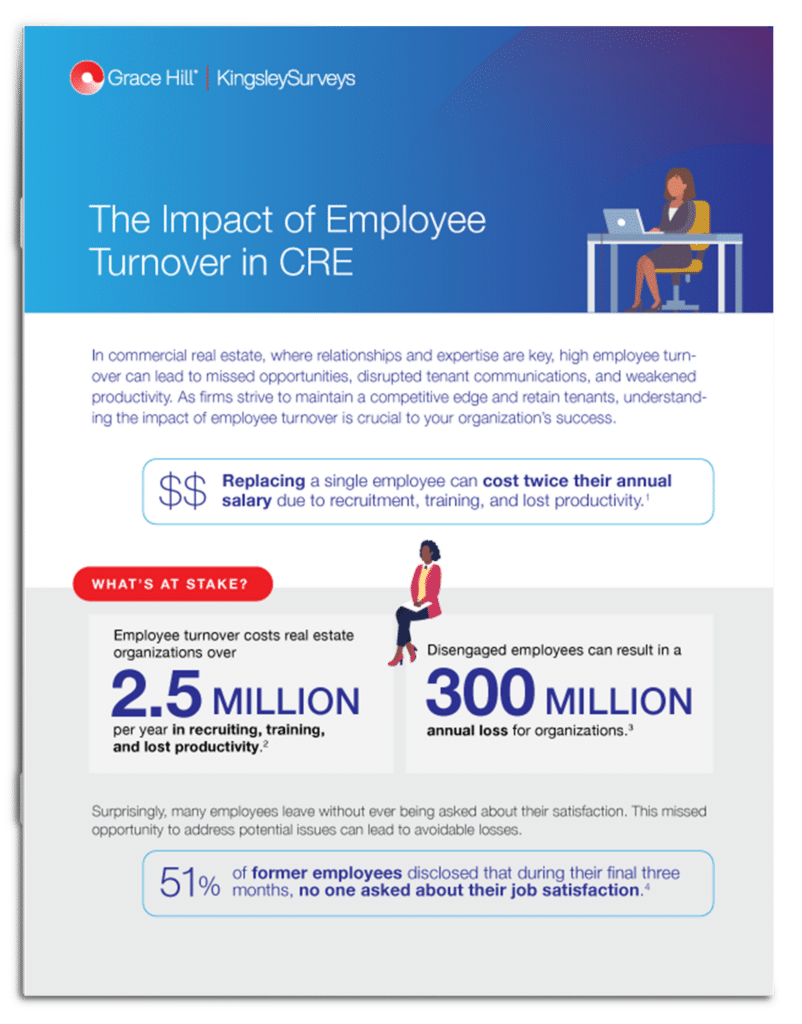

Sustainability and ESG standards have become increasingly important for real estate organizations. Managers must take ESG seriously and adopt best practices to keep their portfolios competitive. A key element of ESG is assessing how property managers and owners engage with their stakeholders, especially their tenants, residents, and employees.

For CRE organizations, conducting third-party surveys will increase your GRESB score and provide unbiased feedback on what matters most to your stakeholders – so you can invest in projects that directly impact overall satisfaction and renewals.

Benefits of ESG Initiatives

Differentiate Your Portfolio

Understand Stakeholder Priorities

Prioritize Investments

Increase Asset Value

What is ESG?

Environmental, social, and governance (ESG) is a term used to represent an organization’s environmental and ethical standards, along with its commitment to being a good corporate citizen.

ESG began in the 1970s with growing environmental awareness and broadened to include social issues in the 1990s. The concept evolved again in 2006 to include governance when the United Nations launched its Principles for Responsible Investment (UNPRI) reporting framework.

Why is ESG important for investors?

The real estate industry has seen increased pressure to adopt ESG best practices. The primary drivers of ESG reporting are not government mandates but encouragement from industry itself. Many leading organizations issue sustainability reports that focus on measuring environmental impacts, as well as social and philanthropic programs.

These voluntary efforts are widely adopted throughout the real estate sector largely due to competitive market pressures from socially-conscious tenants, clients, and investors.

Environmental

Initiatives to protect natural resources.

- Energy Consumption

- Air & Waste Quality

- Waste Management

- Carbon Footprint

Social

Treating internal and external stakeholders well.

- DEI Initiatives

- Customer & Employee Engagement

- Community Relations

- Data Protection

Governance

Management integrity and policies to avoid conflict of interest.

- Transparent Executive Compensation

- Diverse Leadership & Board

- Audit Controls

- Regulatory Compliance Programs

What is GRESB?

GRESB (formerly the Global Real Estate Sustainability Benchmark) is an internationally recognized industry-specific assessment that benchmarks an organization’s ESG efforts, including its processes, management, and portfolio performance. Because ESG initiatives have become more important to real estate industry stakeholders, benchmarks were developed to score an organization’s sustainability efforts.

What does GRESB measure?

GRESB scores an organization based on its processes, management, and portfolio performance in specific ESG focus areas. Key topics assessed include leadership, risk management, energy consumption, greenhouse gas emissions, and tenant and community engagement.

How can you earn an additional GRESB point with Grace Hill?

Your Trusted GRESB Partner

The GRESB framework measures many aspects of an organization’s ESG performance, including corporate policies, assets’ environmental impact, and engagement with stakeholders. Stakeholder surveys are a requirement for GRESB, but organizations can gain an additional point with a third-party engagement program.

KingsleySurveys is a trusted GRESB partner with over 35 years of experience serving the commercial real estate industry. Our team of experts helps clients execute successful engagement initiatives and provide the insights and reports needed for GRESB.

Gain Actionable Insights on Overall Tenant Experience and Perception of:

Overall Areas

- NPS

- Space Needs

- Sustainability & ESG

Service Assessment

- Property Management

- Leasing & TIs

- Maintenance

Property Features

- Amenities

Mounting ESG regulations and industry pressures are pushing real estate managers to adopt evolving best practices. Do you have what it takes to keep your portfolio competitive?

Customer Support

Customer Support