Compliance

April is Fair Housing Month, prompting reflection on reasonable accommodations for multifamily residents, such as providing a designated accessible parking space or permitting an assistance animal request.. Assistance animals are specially trained to assist people with disabilities with mobility, navigation, hearing, emotional support, and medical conditions. Unlike pets, which are kept for companionship, assistance animals… Read More »

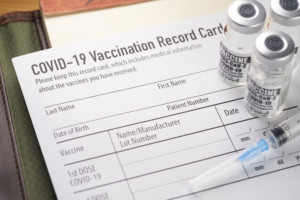

Read MoreLast week we discussed actions property management employers can take while waiting for the new federal vaccine mandate to be finalized. As we mentioned, the mandate will likely impact many of your organization’s processes, such as recordkeeping, confidentiality, reasonable accommodations, and more. While it’s too soon to implement a vaccine policy, now is a great… Read More »

Read MoreTo contain the recent surge in COVID-19 cases, President Biden has proposed a new federal vaccine mandate applicable to certain businesses. The mandate includes the strictest vaccination requirements yet imposed and could affect almost two-thirds of the American workforce, including the property management industry. While the mandate isn’t anticipated to go into effect for several… Read More »

Read MoreComplying with the Extended CDC Eviction Moratorium On March 29, the U.S. Centers for Disease Control and Prevention (CDC) extended its federal eviction moratorium order through June 30, 2021. In response, the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) issued a joint statement announcing that they will increase scrutiny of eviction… Read More »

Read MoreOn January 20, 2021, President Biden signed an executive order that broadens protections that the Bostock v Clayton County Supreme Court ruling provides LGBTQ+ individuals. The Bostock ruling applies specifically to discrimination in the workplace; however, the executive order extends those protections to other areas, including housing, making gender identity and sexual orientation protected under… Read More »

Read MoreGrace Hill has partnered with NAAEI and iEmpathize to create a new course that educates Florida multifamily employees on the dangers, signs, and prevention tactics of human trafficking. The new course is approved by the Florida Department of Business and Professional Regulation (DBPR) to meet Florida’s new training requirements. In addition, a new Human Trafficking… Read More »

Read MoreTips for establishing your strategy on rent collection, late fees, and evictions upon reopening.

Read MoreStragies for balancing resident satisfaction and safety when resuming amenity and maintenance services.

Read MoreA new series of free articles and tools that help multifamily companies balance safety, resident satisfaction, company viability, and legal compliance while reopening

Read MoreStrategies for maintaining an excellent customer experience regardless of whether the leasing is done virtually or in-person.

Read MoreA roundup of articles offering solid advice on how property management companies can maintain safety and stability in these uncertain times.

Read MoreStay Compliant with Grace Hill’s Checklist You may not have experienced a conflict with Fair Housing compliance yet, but multifamily companies are vulnerable to such lawsuits from multiple fronts, and violations can be costly. For example, in April 2019 HUD reported that civil penalties for Fair Housing violations may be levied up to $16,000… Read More »

Read More